A Sense of Urgency Coupled With Caution for Potential Investors

Last month, we shared the hypothetical story of Ruth & Jim … a couple who were financially well-off, but who faced the potential for a major capital gains tax bite. As an intelligent move, they sought advice from their trusted financial advisors. That effort led to their learning of a provision of the new tax law that converts long-term capital gains to tax savings … plus the potential for substantial long-term investment growth. All these benefits are elements of investments in a Qualified Opportunity Fund (QOF) … a tax-favored investment vehicle designed to attract capital gains profits to be reinvested in low-income communities.

Click here for more detail on the explanation Ruth and Jim received from their financial and accounting advisors.

Note From Kyle

I freely admit that I am not a professional when it comes to interpreting tax law. That said, you are urged to meet with your tax advisor and seek professional guidance for the specifics of QOF investments as may apply to your unique circumstances. Here, I present only my understanding as a real estate investor of the potential benefits and investment considerations.

Sense of Urgency!

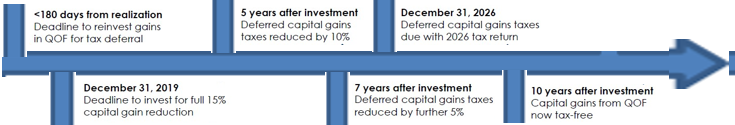

Now to the sense of urgency referred to above. If you are an interested investor, you must exhibit a sense of urgency to participate in a QOF. Investors will pay tax on the deferred gain when they sell the QOF investment. To enjoy the maximum tax benefit … seven-year fifteen percent “forgiveness” … means the investment must be made before the end of 2019.

How may the new regulation apply to your unique circumstances? There is a myriad of rules, exceptions to the rules, interpretations of the rules and special circumstances to be reviewed, considered and evaluated. If you have a thirst for knowledge, click here to access the IRS Frequently Asked Questions site regarding Qualified Opportunity Zones eligible for QOF investments.

However, this is not a DIY endeavor. Do promptly schedule a meeting with your tax advisor to determine how you may benefit.

KRS Holdings stands ready to refer you to Trusted Advisors who you may choose

to contact to review your qualifications for these major tax relief and investment potential benefits.

Call or email … we’ll respond promptly.

Some Words of Caution

Certainly, your meeting with your trusted advisors will reveal whether investment in a QOF is an appropriate financial move for you. Here are a few issues that are likely to surface for discussion.

- A QOF is essentially an investment in commercial real estate or real estate development. That means implementation and management of the fund are key components.

- Are you likely to need to access funds invested in a QOF within the next 10 years?

- Is the QOF consistent with your overall investment objectives? Remember, tax savings are not an investment objective … albeit a “nice-to-have” when available.

- How QOFs are structured and how the underlying assets are managed must be evaluated carefully to avoid any unpleasant surprises.

- Do potential QOF management fees, other costs and risk factors justify your investment? For example, if you spend the same amount in direct costs as you may save in capital gains taxes plus ladle in the unknown risk factors … does it make sense?

- Are you prepared to be a passive investor in economically distressed Qualified Opportunity Zones? The risk of potential loss is one factor. Another is the possibility for social and political criticism of “gentrification” of low-income neighborhoods that may displace or otherwise inconvenience current residents.

Summary

Congress designated about 8,700 Qualified Opportunity Zones (QOZ) which may be investment targets via QOFs. The tax incentives are such that business and individual investor capital are likely to be attracted to these low-income areas. That said, investments in QOFs is a relatively new financial vehicle and carry specific risks, restrictions and qualification requirements that must be thoroughly vetted by investors.